Workshops

"The secret of getting ahead is getting started"

- Mark Twain

Investor Awareness Programme (IAP)

Empowering investors through education

We hosts a comprehensive investor awareness program, offering insights, tools, and guidance for informed financial decision-making and long-term wealth preservation.

Did you know ?

Objectives Of The Programme

Empowering investors through education

Enhance financial literacy by providing practical information on investment options, strategies, and market dynamics.

Empower investors with knowledge for informed decisions on investments, retirement, tax management, and financial well-being.

Encourage disciplined financial planning with clear goals, personalized strategies, and regular review and adjustments.

Educate on investment risks and effective risk management techniques for wealth protection and growth.

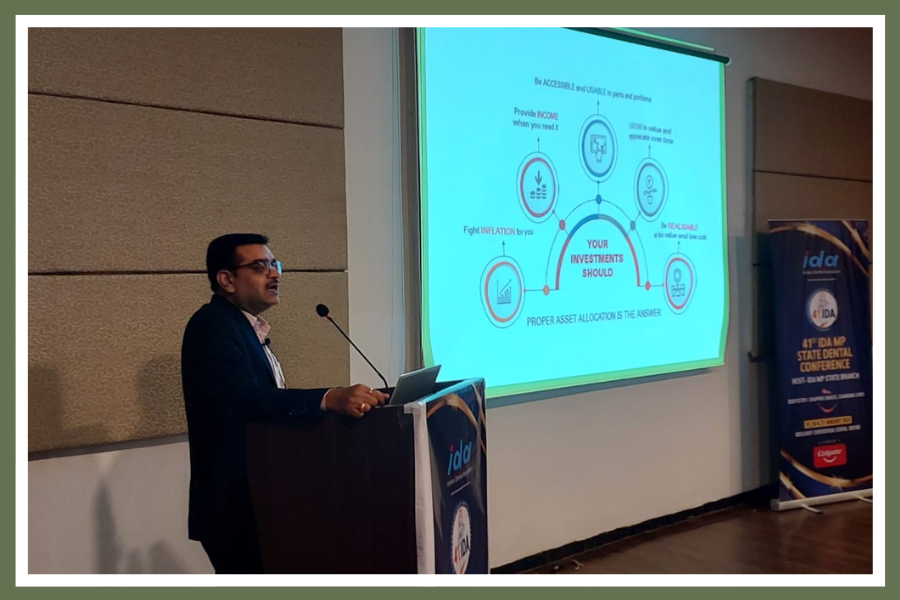

Highlight the benefits of spreading investments across asset classes for risk mitigation and long-term returns.

Offer access to experienced advisors for personalized advice and support tailored to individual financial goals.

Instill accountability in managing finances, planning for the future, and working towards financial goals.

Keep investors informed about market trends, emerging sectors, and technologies impacting their portfolios.

Advocate for considering ESG factors and aligning investments with values for ethical and sustainable outcomes.

Establish metrics to evaluate programme effectiveness and track investors' progress in achieving financial goals.

Features of Programme

-

Interactive Workshops

Engage investors through hands-on sessions, demystifying complex financial concepts with real-life examples.

-

Personalized Assessments

Tailored financial health evaluations to empower investors with insights into their unique financial situations.

-

Expert Guidance

Access to seasoned wealth advisors offering personalized strategies to achieve financial goals.

-

Innovative Tools

Explore cutting-edge financial tools and technologies designed to enhance investment decision-making.

-

Market Insights

Stay ahead with up-to-date market trends and investment opportunities shared by industry experts.

-

Networking Opportunities

Connect with like-minded investors, fostering a supportive community for knowledge exchange and collaboration.

-

Continuous Support

Ongoing assistance and guidance beyond the program to ensure sustained financial success.

Is This Programme For You?

Our Investor Awareness Programme caters to a diverse range of audiences, providing valuable insights and practical guidance to empower individuals with the knowledge and tools needed for financial success. Specifically, our programme is tailored for:

Equip employees with essential financial literacy skills and investment knowledge to make informed decisions about their financial futures. Our workshops delve into topics such as retirement planning, tax management, and wealth accumulation strategies.

Offer tailored sessions for members of professional associations, providing comprehensive education on personal finance, investment opportunities, and wealth management strategies. Our workshops address the unique financial needs and goals of association members, fostering financial empowerment and security.

Empower SME owners and employees with the knowledge and tools to optimize financial resources, manage cash flow effectively, and make strategic investment decisions. Our workshops are designed to enhance financial literacy and promote long-term financial sustainability for SMEs.

Provide customized workshops for NGO staff and volunteers, focusing on financial planning, fundraising strategies, and asset management. Our goal is to strengthen the financial management capabilities of NGOs, enabling them to better serve their communities and achieve their missions.

Deliver specialized workshops for students and faculty at business schools, covering essential topics in finance, investment analysis, and portfolio management. Our workshops supplement academic curricula with real-world insights and practical skills, preparing students for successful careers in finance and business.

Offer educational workshops for residents of housing societies, addressing topics such as budgeting, homeownership, and property investment. Our goal is to empower residents with the knowledge and tools to make informed decisions about their housing finances and investments.

Provide comprehensive workshops for individuals and families seeking to enhance their financial literacy and achieve their financial goals. Whether planning for retirement, saving for education, or building wealth, our workshops offer practical guidance and actionable insights tailored to individual needs.

Our workshops, conducted by experienced professionals, are customizable to meet specific organizational requirements and time durations. Join us in our mission to empower individuals and organizations with the knowledge and tools for a brighter financial future.

Content of programme/ workshop

The program can be customized according to the your requirements and the duration can be anywhere from 2 hrs – 1 full day. The broader content revolves around

- Insurance planning

- Investment planning

- Retirement Planning

- Estate Planning

- Tax Planning

Insurance planning is vital to protect individuals and businesses from unforeseen financial losses due to accidents, illnesses, natural disasters, or other unexpected events, providing peace of mind and financial security.

Investment planning is essential for securing financial future by maximizing returns, mitigating risks, achieving long-term goals, and maintaining financial stability amidst changing economic conditions and personal circumstances.

Retirement planning ensures financial security post-employment, maintaining desired lifestyle, covering healthcare costs, and safeguarding against unforeseen expenses, allowing individuals to enjoy their golden years worry-free.

Estate planning ensures efficient distribution of assets, minimizes taxes, avoids family disputes, provides for loved ones, and allows individuals to dictate healthcare and financial decisions if incapacitated.

Tax planning is essential to optimize financial resources, minimize tax liabilities, comply with regulations, and maximize available deductions, credits, and exemptions, ensuring efficient wealth management and business sustainability.

We believe in empowering

Over past two decades with over 70+ IAP's our motive is just to make people Fiancially Empowered

Indian Dental Association

Indore

Index Medical College

Indore

IMA

Nanded

Impetus

Indore

47 Billion

Indore

Yash Technology

Indore/ Hyderabad/ Pune

Premier Biosoft

Indore

Radius consultants

Indore