We Help You With

At Rathi Wealth, our services are more than just offerings—they’re chapters in your financial story. We believe every journey is unique, and we’re here to guide you with unwavering trust, clarity, and empowerment. Imagine a path where every step is supported by integrity and personalized expertise, from uncovering new opportunities to safeguarding what matters most, and ensuring your legacy endures for generations.

Our approach blends time-tested wisdom with innovative strategies, creating a seamless experience that transforms aspirations into lasting prosperity. Whether you’re seeking to expand your horizons, protect your achievements, or lay the groundwork for the future, our dedicated team is with you every step of the way. Explore our services and discover how we can help you write your success story with confidence and purpose.

We believe that financial planning is must for everyone, and with that with make sure that you get best of service making sure your overerall financial wellbeing .

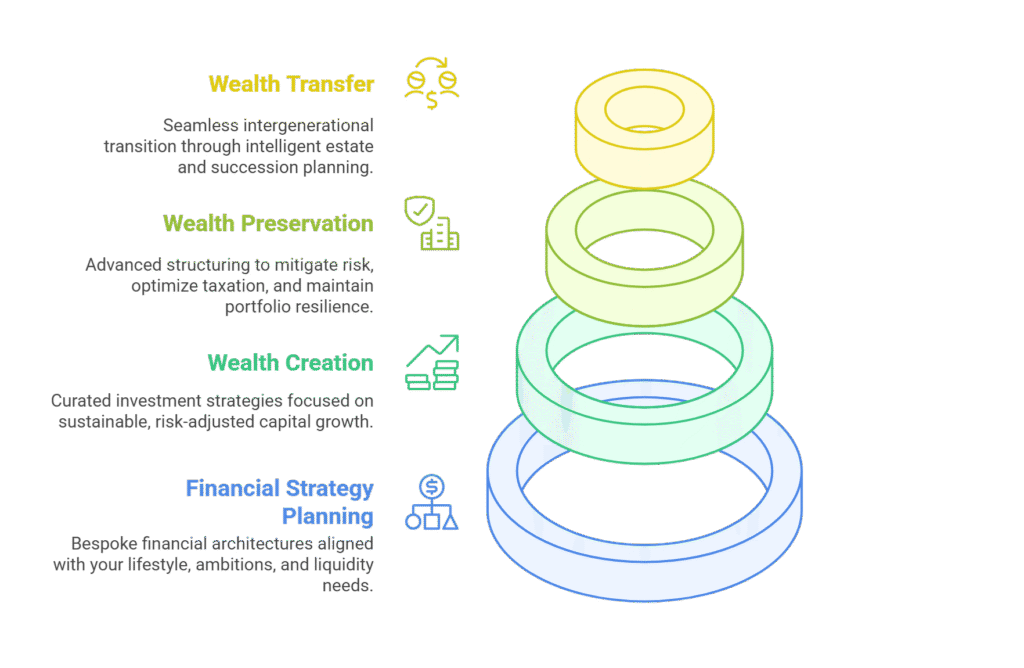

Financial Strategy Planning

Goal Setting

Clients work with us to set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These goals can include objectives like saving for retirement, buying a home, paying for education, paying off debt, or building an investment portfolio and more.

Budgeting and Cash Flow Management

Saving and Investment Strategy

Insurance Planning and management

Loan and Liability Management

Tax Planning

Overall Financial Health Analysis

Wealth Creation

Wealth Preservation

Wealth Transfer

Item #1

Item #2

Item #3

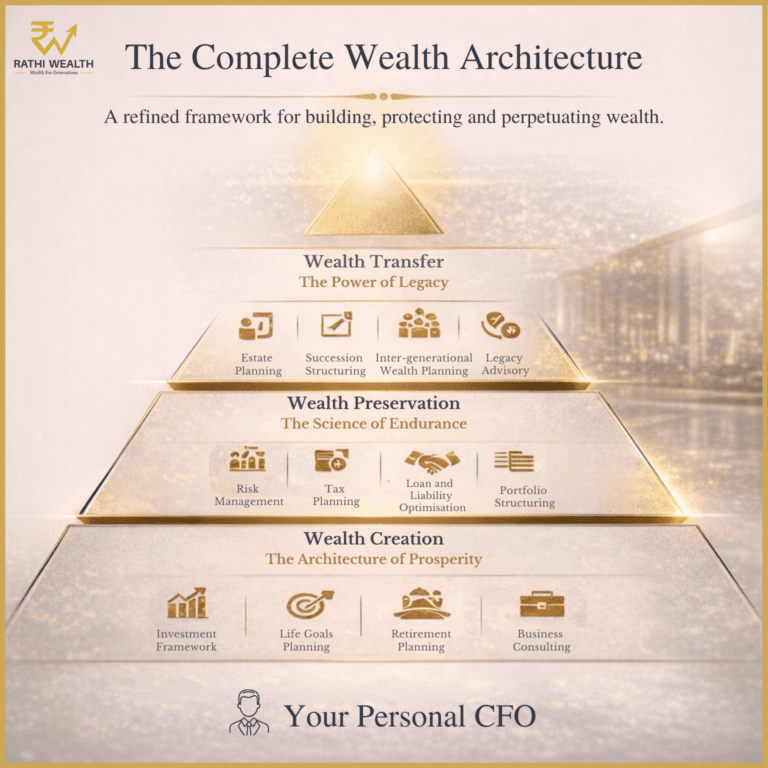

Complete Wealth Architecture

Your Personal CFO

At Rathi Wealth, we don’t offer isolated services. We follow a philosophy—one that mirrors how true wealth is created, sustained, and passed on.

Wealth Creation : The Architecture of Prosperity

This is where ambition is transformed into structured capital. We design intelligent financial systems that convert income, enterprise and opportunity into enduring wealth.

Includes:

Investment Framework· Life Goals Planning · Retirement Planning · Business Strategic Consulting

We don’t chase growth. We engineer it.

Wealth Preservation : The Science of Endurance

As wealth grows, its protection becomes more critical than its expansion. This stage ensures resilience—shielding your capital from inefficiencies, volatility and avoidable risks.

Includes:

Risk Management · Tax Planning · Loan & Liability Optimization · Portfolio Structuring

It’s not market cycles that erode fortunes—it’s the absence of structure.

Wealth Transfer : The Power of Legacy

True wealth is not what you accumulate—it’s what you orchestrate forward. This phase ensures continuity, clarity and control across generations.

Includes:

Estate Planning · Succession Structuring · Intergenerational Wealth Planning · Legacy Advisory

The highest form of wealth is permanence.

Goal Setting

Clients work with us to set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These goals can include objectives like saving for retirement, buying a home, paying for education, paying off debt, or building an investment portfolio and more.

Budgeting And Cash Flow Management

Developing a budget is a fundamental aspect of wealth coaching. We assist clients in creating a budget that aligns with their financial goals and helps them manage their income and expenses effectively . A well-structured budget ensures that you live within your means, save for your goals and avoid overspending.

Saving, Investment Guidance and Strategies

We work with clients to Determine how much to save and invest to achieve their financial goals. Wealth coaching involves providing guidance on investment options and strategies. We then help clients to create diversified investment portfolios selecting appropriate investment vehicles, such as stocks, bonds, mutual funds, and real estate, based on their risk tolerance and time horizon.

Tax Planning

We work with clients to optimize their tax strategies, which can include advice on tax-efficient investments, retirement accounts, and deductions. This can help clients reduce their tax liability and save more of their money.

Retirement Planning

Retirement planning is a significant part of wealth coaching. We work with clients in estimating their retirement needs, setting retirement goals and creating a plan to save and invest for their retirement years.

Loan Management

For clients with outstanding debts, we work with them to create a plan to reduce and eliminate debt while avoiding high-interest payments. This may include strategies like debt consolidation or negotiation. A debt repayment plan is often a crucial component of Wealth Coaching.

Risk Management and Insurance

We assess client’s insurance needs, including life insurance, health insurance, and disability insurance, to ensure they are adequately protected against financial risks to protect them, their family and their assets.

Estate Planning

We help clients create and update legal documents like wills, trusts, and other mechanisms to ensure the smooth transfer of their wealth to heirs efficiently and the management of their affairs in case of incapacitation or death.

Suitable Financial Product

we meticulously work with clients through a tailored process, ensuring they make informed decisions aligned with their financial goals. With expertise and dedication, we simplify complexities, empowering clients to navigate confidently in the realm of financial products.

Who Is It For ?

Our services cater to a diverse range of clients, including:

We partner with a select group of individuals and institutions who approach wealth with intent, discipline and long-term vision.

- Individuals seeking personalized wealth management solutions.

- Families looking to secure their financial future and plan for generations.

- High-net-worth individuals requiring specialized investment strategies.

- Business owners seeking to optimize their company’s finances and assets.

- Professionals aiming to grow their wealth while focusing on their careers.

- Retirees looking for reliable income streams and asset preservation.

- Trustees and beneficiaries of trusts and estates in need of financial management.

- Institutions such as foundations and endowments seeking strategic investment guidance.

- Charitable organizations aiming to maximize the impact of their assets.

- Any individual or entity committed to achieving their financial goals with expert guidance and support.

Individuals who want intelligent wealth decisions—not guesswork.

Families building financial security across generations.

High-net-worth individuals needing precision, privacy, and performance.

Business owners aligning personal wealth with business growth.

Professionals growing wealth without losing focus on their careers.

Retirees seeking certainty, income, and capital protection.

Trustees & beneficiaries demanding structure, clarity, and accountability.

Institutions & foundations focused on sustainable, long-term impact.

Charitable organizations optimizing every rupee for real change.

Those who take their financial future seriously.

• High-net-worth individuals & families focused on legacy, not lifestyle inflation.

• Business owners & founders aligning personal wealth with enterprise growth and exit strategy.

• Senior professionals & CXOs who want their money working intelligently while they focus on impact.

• Retirees & near-retirees seeking predictability, dignity, and capital protection.

• Trusts, institutions & foundations requiring structure, governance and long-term stewardship.

In essence: We serve those who don’t just earn wealth—they manage it with purpose.

Our Process

From Complexity to Clarity. From Wealth to Legacy.

Initial Inquiry and Discovery

Assessment and Goal Setting

Client Education and Empowerment

Financial Analysis and Planning

presentation of Recommendation

Implementation

Ongoing Monitoring and Review

Rebalancing and Adjustments

Financial Reporting and Documentation

Coaching and Support

Client Relationship Management

Initial Inquiry and Discovery

Understanding client’s scenario

Assessment and Goal Setting

Client Education and Empowerment

Strategy And Implementation

Ongoing Monitoring and support

Lets Transform Your Financial Aspirations Into A Vibrant And Prosperous Reality.

Join us in your journey towards financial success, and let us guide you to a brighter and more secure tomorrow.

Calculators

-

Dream

Education Calculator

Dream

Education Calculator -

Grand Wedding Calculator

Grand Wedding Calculator -

Dream

Car Calculator

Dream

Car Calculator -

Dream

Vacation Calculator

Dream

Vacation Calculator -

Dream Retirement Calculator

Dream Retirement Calculator -

Life Insurance Need Calculator

Life Insurance Need Calculator -

SIP Calculator

SIP Calculator -

Lumpsum Calculator

Lumpsum Calculator -

Cost Of Delay Calculator

Cost Of Delay Calculator -

EMI Calculator

EMI Calculator -

Limited Period SIP Calculator

Limited Period SIP Calculator -

Home Loan SIP Calculator

Home Loan SIP Calculator -

SIP Top Up Calculator

SIP Top Up Calculator